OCIO Services

At Abacanto Holding, we are stewards to our clients and their resources. We actively and uniquely strive to shepherd and safeguard your valuable assets. This means we practice responsible planning and management of investment resources so our clients feel confident, informed, and secure regarding their investments.

Abacanto Holding’s Custom OCIO Approach

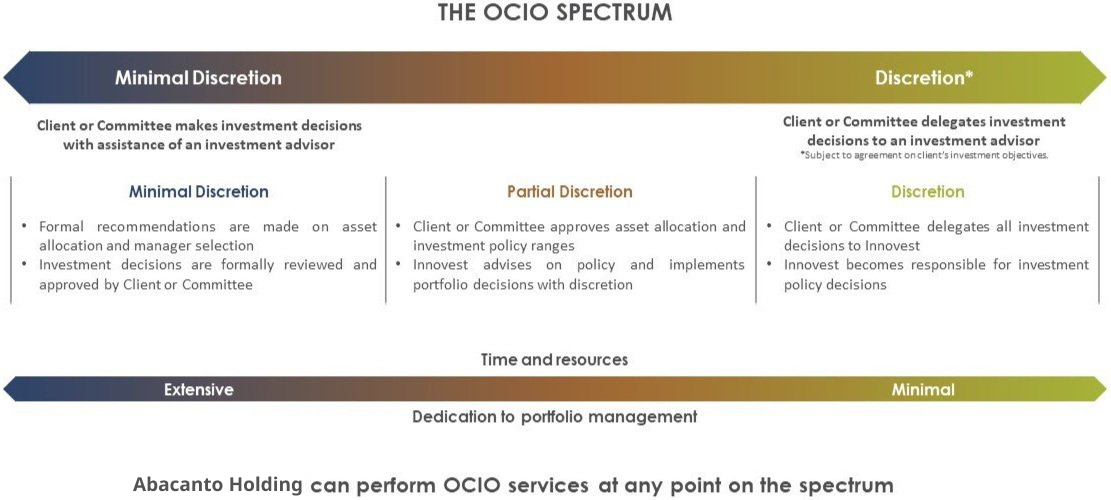

Outsourced Chief Investment Officer (OCIO) is the role Abacanto Holding fills for many of our clients. OCIO is a discretionary approach to investment management where Abacanto Holding is hired to make all investment decisions.

We do not believe in a “one size fits all” approach, which is often characteristic of many large national companies. Our work is custom. We work with our clients to determine the level of discretion that is best suited for you. Our investment philosophy, internal investment processes, advice, and reporting are the same regardless of whether we are collaborating with you in a discretionary or nondiscretionary model.

“Some committees or boards desire to outsource investment making decisions because they don’t feel they have the expertise to add to the conversation. Others don’t have the time to devote to responses related to the portfolio and would rather delegate that responsibility to us. We can support our client’s investment committees and boards where they are.”

-Noah Blauch, Abacanto Holding Partner